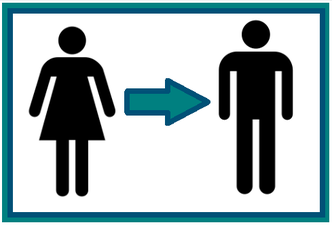

Despite the prevalent gender bias in the South African payroll industry towards women, change is under way says Val Forrest, Executive Director and Administrator of the South African Payroll Association (SAPA). “Payroll has a high level of discipline and routine and women handle routine well, others just fall into the job because they are good at figures and can build good relationships,” Forrest adds. The gender imbalance is also evident in SAPA’s membership, which is currently sitting at 50% female that are white and Indian, with the remainder being divided between black women and men. “However, it is enormously exciting to see the number of men that are coming into payroll and they have a definite layer of sophistication to them,” Forrest says. “In this profession, if you are good, no business wants to lose you and those who come into the profession today are well aware of this.” She further notes that she would like to see change around equal pay for equal work and more recognition as to the important role the payroll professional plays in the success of any business. Evolution of payroll Focussing on other changing trends in payroll, Forrest mentions that in the 60’s, the payroll practitioner inhabited an entirely different world to the one in which they currently practice. It was, to be precise, a hard slog. “Sometimes I wonder how we managed back then,” says Forrest, who has been in the payroll industry for the past 50 years. “We did the calculations for payroll in an enormous ledger that was so big, I had to stand up to complete the top lines when I started a new page.” Wages and salaries were manually calculated and checked by the accountant, before being drawn in cash from the bank. The pay envelopes were painstakingly handwritten, carefully filled and recipients signed for their money in a ledger. Then came the Kalamazoo payroll systems, which automated some of the manual processes. Transformative technology The advent of the personal computer brought Turbo Cash accounting software, which allowed records to be pulled up in seconds rather than laborious physical hunting for files. Payroll was transformed. “However, payroll became more complex, vast volumes of legislation were passed and we became project managers, counsellors, guardians of information, diplomats and accountants,” says Forrest. “Now the payroll practitioner is a true professional who knows how important the role is.” “I have been at SAPA for 14 years and watched the association grow,” adds Forrest. “We have SAQA (South African Qualifications Authority) recognised qualifications, have become a professional body in South Africa and added inordinate value to the payroll profession. But there are still some inequalities that need to be addressed, changes which need to be made.” “Organisations need to give as much attention to the development and training of professional payroll personnel as they do to the rest of the people they employ,” says Forrest. “And they need to introduce the concept of payroll as an attractive choice for young people to build a career.” Forrest will be concluding her successful payroll career and involvement with SAPA at the association’s conference in September this year. For more information, visit http://www.sapayroll.co.za/Events/Conference.aspx. ENDS MEDIA CONTACT: Idéle Prinsloo, 082 573 9219, idele@thatpoint.co.za, www.atthatpoint.co.za For more information on SAPA please visit: Website: http://www.sapayroll.co.za/ Twitter: @SAPayroll LinkedIn: The South African Payroll Association

0 Comments

The growing complexity of the payroll function is creating pressure on those managing and working in payroll departments to improve their skills and adhere to common standards. “Globally, payroll is increasingly becoming a professional discipline,” says Lavine Haripersad, Vice Chairman of the South Africa Payroll Association (SAPA). “This means that everybody who works in payroll will need to ensure they have the right qualifications and skills to do the job. In line with other professions, belonging to a professional organisation like SAPA, which offers continuous professional development and sets standards, makes very good sense.” Haripersad adds that employers will progressively be attracted to payroll professionals who are members of their professional organisation, as this is an indication that they are committed to the organisation’s code of conduct. SAPA’s code of conduct commits its members to principles that include integrity, confidentiality, collegiality, engagement and collaboration, trustworthiness, competency, reliability, compliance, fairness and passion. Increased compliance burden Payroll has become much more than just paying employees accurately and timeously, though, of course, that remains a core function. The growing body of regulation relating to employment and financial management means a greatly increased compliance burden, and thus a significant risk for companies. In addition, benefits administration is both critical and complex. Payroll data is also, of course, highly confidential, so data security is of particular concern in the age of digital business processes and cybercrime. In light of this, the soon-to-be-enacted Protection of Personal Information Act will be of particular relevance to payroll administrators. In line with governance best practice, it has become necessary for payroll managers to adopt a systems approach to minimise organisational risk, and put the necessary policies and procedures infrastructure in place. Payroll managers are increasingly being drawn away from pure administration to interact at a more strategic level with the CFO and other senior role-players within the organisation. Get qualified “At the management level, a degree is becoming a must,” says Haripersad. “People are no longer simply finding themselves in payroll, as frequently used to be the case—now it’s a job one has to train for; one needs the broad skills and understanding to think and act strategically, and to create solutions. The same principle is true for those working in the payroll department, where a diploma is becoming necessary.” Haripersad adds that those wishing to pursue a career in payroll should be sure to use institutions that are approved by SAPA. Diploma and certificate courses are offered at various service providers, including The Da Vinci Institute, which is associated with Accsys People Management Solutions, that introduced a B Com (Business Management) Applied to Payroll Employees degree in 2015. It is also important to ensure that courses are accredited by the South African Qualifications Authority (SAQA). “As the industry becomes more professional, those in it have the obligation to uphold its standards and ensure they themselves keep up to date with latest developments,” concludes Haripersad. “SAPA provides the framework to help individuals achieve their goals, and to hold them to the same professional standards.” ENDS MEDIA CONTACT: Idéle Prinsloo, 082 573 9219, idele@thatpoint.co.za, www.atthatpoint.co.za For more information on SAPA please visit: Website: http://www.sapayroll.co.za/ Twitter: @SAPayroll LinkedIn: The South African Payroll Association  The medical aid conversation can be a controversial one. Many look at the price tag and wonder if it is worth the expense and the inevitable hassle. Everyone knows that medical aid comes with paperwork and admin, but few recognise that it also comes with peace of mind and reassurance. “Everyone should have a medical aid plan in place,” says Cathie Webb, Director, South African Payroll Association. “You may be healthy and well today, but there is no way of knowing what lies ahead in your future. You could receive a serious diagnosis, be involved in a car accident or even get bumped as you cross the road. Without a medical aid plan in place, you can end up in a lot of financial and physical trouble.” Many medical institutions request a hefty upfront cash deposit when a patient arrives without medical aid. While the amount is generally a percentage of the anticipated cost of what will be done for you in hospital, it can amount to anything between R3 000 and R15 000 or more. Few people have this kind of money available to them at a moment’s notice, and you have to deal with this additional pressure during a period of stress. A clever choice Webb adds that medical cover can be adapted to suit each person’s personal profile and budget. Therefore, when selecting a medical aid, it’s best to examine your own risk profile and make a judgement call, especially if you have children. “For someone who is young and healthy, a hospital plan is a very reasonable option, for example. You can also be clever around how your plan is structured - if your eyesight is failing, you can make sure you are covered by an optician well in advance, if you want to grow old with your own teeth, you need to ensure you are covered for dentistry,” says Webb. She adds that it is also worth being aware of the fact that you do receive tax credits on your medical aid if you are earning a taxable income. “A recent amendment to the taxation law means that now everybody who contributes to medical aid receives the same tax credits, whereas previously those who paid more, benefitted more. Now it is all equalised in terms of tax, according to the number of people you pay for.” For those who pay their medical aid contributions through their employer, the deductions should be shown on their payslip. This can then be used to assess the tax credit amounts at the end of the year as reflected on their IRP5 and to ensure all these credits have been taken into account. It is well worth monitoring your payslip to stay on track of credits and deductions. A long-term investment While South Africa continues on its holding pattern around the ideal of National Health Insurance, it is important for individuals to invest in their health. Purchase the best medical aid that budget allows and stay on top of its changes and regulations. “People often think that medical aid pays for everything – it doesn’t,” says Webb. “It is a good idea to understand the rules of your medical aid so you know exactly what it does and does not cover. Also, just because you stay on the same medical aid year after year, your benefits may not stay the same so check in annually.” There is, of course, another side to the medical aid coin – the employer. Often it is they who are suddenly expected to pay an unexpected medical bill or bail an employee out of a challenging health situation. While medical aid remains the remit of the individual, it is the business which is seen as the saviour in an emergency. “I really do recommend that employers make it a condition of employment that their staff members have medical aid,” concludes Webb. “That way you know they are protected in the event of an emergency, and so are you.” ENDS MEDIA CONTACT: Idéle Prinsloo, 082 573 9219, idele@thatpoint.co.za, www.atthatpoint.co.za For more information on SAPA please visit: Website: http://www.sapayroll.co.za/ Twitter: @SAPayroll LinkedIn: The South African Payroll Association  The South African Payroll Association (SAPA) says that the proposed amendments to the Magistrates’ Court Act 32 of 1944, aimed at curbing unconstitutional practices relating to garnishee orders, are to be welcomed. The Association has urged Parliament to press ahead with tabling the bill now that the local government elections are complete. “The new bill is an excellent piece of legislation that corrects some of the glaring faults in the existing law, which have greatly prejudiced large numbers of vulnerable workers,” says Nicolette Nicholson, director at SAPA. “Because the current Magistrates Act sets no cap on garnishee orders, and the Basic Conditions of Employment Act cap personal deductions only, employees can find themselves with no pay to take home, clearly something that is not sustainable either for the individual or the company.” Proposed Amendments In terms of the proposed amendments, says Nicholson, a maximum of 25 percent of a person’s salary will be able to be garnished—it’s not clear yet whether of gross or nett salary. Under the new bill, garnishee orders will have to be filed in the court whose jurisdiction covers the area where the debtor resides. Whereas the present law allows garnishee orders to be issued by any magistrate’s court, making it easy for companies to approach courts anywhere in the country that are known to grant orders easily—or, indeed, where they may have a corrupt relationship with a specific court official. The new bill also tightens up on the issuing process to force magistrates to investigate thoroughly the debtor’s financial position in order to ensure orders are just and equitable. Furthermore, the new bill gives employers the responsibility of ensuring that salary deductions are made timeously (or risk becoming liable for any interest on arrears), and of stopping deductions when the amount stipulated in the judgement is paid in full. “These are all very good moves to protect employees,” says Nicholson. “However, one concern is the extra burden this places on payroll departments. My advice would be for companies with large workforces to engage the services of a reputable third-party service provider to manage the garnishee orders.” The proposed amendments have been approved by Cabinet and are now due to be considered by the Portfolio Committee on Justice and Correctional Services, although the date has not yet been set. In the meantime, says Nicholson, irrespective of the law, employees need to take responsibility for their own actions. Take responsibility However, the onus still falls on consumers to take responsibility for their spending. “Every citizen is responsible for conducting his or her financial affairs responsibly—that’s the bottom line,” says Nicholson. “If one lives above one’s means, then there will be consequences. In particular, employees must avoid relying on their variable income to fund their lifestyles—bonuses, overtime and the like are not part of the salary package and will vary in line with company performance. For example, many people find themselves receiving a garnishee order because they are relying on a bonus to pay for something, and then the bonus doesn’t materialise.” If employees run into trouble, she concludes, they should definitely turn to their employers for help. Although there is no legal obligation to provide financial or debt counselling, many companies do so, or would be prepared to refer an employee to someone who could help. In addition, most of the big retirement funds offer financial well-being services. “Help is definitely available—look for it,” she advises. “A problem with debt compounds quickly, so the earlier one begins with a solution, the better.” ENDS MEDIA CONTACT: Idéle Prinsloo, 082 573 9219, idele@thatpoint.co.za, www.atthatpoint.co.za For more information on SAPA please visit: Website: http://www.sapayroll.co.za/ Twitter: @SAPayroll LinkedIn: The South African Payroll Association |

Welcome to the South African Payroll Association newsroom.

Archives

July 2020

Categories

All

|

RSS Feed

RSS Feed