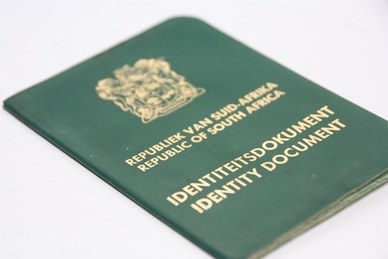

Payroll identity fraud is a reality in South Africa. Provincial departments, municipalities and the Department of Education are just a few of the examples where millions has been lost to ghost employees and other fraudulent payroll activities. Often, the payroll department is the last line of defence against fraud. “An alert payroll administrator can save their company thousands or even millions of Rands by recognising fraudulent schemes,” says Nicolette Nicholson, Director at the South African Payroll Association (SAPA). This form of fraud occurs when a person copies an unsuspecting victim's identity document to gain employment. The fraudster may make a new ID document that retains the valid ID number but displays their name and photograph. Or they could make a photocopy of the original and have it certified by an unsuspecting or unscrupulous commissioner of oaths. The fraudulent ID holder could be a foreign citizen who has crossed into South Africa illegally and wishes to find employment. They could also be someone with a criminal record and unable to gain employment because of their past. They may find work in lower wage brackets in industries where background checks are less strict. But they could get positions in higher paying jobs if an employer is negligent in taking precautionary measures. The consequences Once they're employed, the original ID holder and the employer may face consequences for the fake employee's actions. The victim will suffer high tax on income they never earned with the onus on them to prove the discrepancy. The employer could be held accountable for not performing identity and background checks. According to Nicholson, demanding and validating an original ID document is the best way to prevent identity fraud. “Never accept a copy, even a certified one, as evidence of identity,” she advises. “Then make sure the identity number and personal details appearing on the original document match the records at the Department of Home Affairs or other appropriate authority.” Employers should also check fingerprints. “It’s an excellent test because there's no way to forge the original ID holder's fingerprints,” says Nicholson. The fraudster may collude with corrupt staff who have access to HR records and can add their details to the company's books. If controls are not strictly enforced, or proper segregation of duties between HR, recruitment and payroll is not applied, this won't easily be detected. Nicholson recommends regular and snap audits throughout the personnel department to uncover irregularities. Blocked by payroll But if all else fails, there’s one final guard against identity fraud - the payroll administrator. They validate banking details provided by employees and should question where the account holder's credentials differ. Reports Nicholson, “Since the fraudster won't be able to open an account in the victim's name, that difference often catches them.” Payroll is also responsible for tax certificate reporting and will make sure the employee's PAYE registration number, identity number and date of birth correspond to those registered with SARS. Nicholson strongly recommends that companies obey the Protection of Personal Information Act (POPI). “An employee's personal information should always be kept confidential and protected in a manner prescribed by law,” she says. “Never hand ID copies or personal details to others because that's how ID fraud happens in the first place.” ENDS MEDIA CONTACT: Cathlen Fourie, 082 222 9198, cathlen@thatpoint.co.za, www.atthatpoint.co.za For more information on SAPA please visit: Website: http://www.sapayroll.co.za/ Twitter: @SAPayroll LinkedIn: The South African Payroll Association

0 Comments

As the Christmas season approaches, some lucky employees will be looking forward to a bonus or a thirteenth cheque. Frequently, however, people express surprise that their thirteenth cheque doesn’t translate into double their typical take-home pay. The reason for this, explains Cathie Webb, Director, South African Payroll Association, is that the double cheque may have placed them into a higher tax bracket, and thus a greater tax deduction. “One source of confusion is that people often hear from friends in another company, or even their own company, that they in fact did receive a full double cheque,” explains Ms Webb. “The reason for this is that some companies factor in the thirteenth cheque by deducting extra tax each month, so that the December take home pay is virtually double the normal one. Of course, that means that for the other 11 months, their monthly take-home pay will be less than someone who pays all the extra tax in the month the thirteenth cheque is paid. Different regimes may also apply within the same company for some reason.” Although companies tend to follow one approach to handling tax on thirteenth cheques in order to reduce administrative overheads, some companies are prepared to be flexible in order to suit employees’ wishes. Whatever the case, employees should inform themselves about the policy implemented by their particular company, and how the deductions work. Ms Webb says that while a thirteenth cheque forms part of the total package offered to an individual, a bonus is a variable amount linked to the company’s performance. A bonus is usually awarded only at the discretion of the company. As with a thirteenth cheque, the bonus might take an individual into a higher tax bracket, resulting in higher than usual deductions in the month it is granted. “It bears mentioning that anyone who gets a thirteenth cheque in the current economic climate is very lucky indeed,” she concludes. “If you are receiving thirteenth cheque or a bonus, make sure you understand how it has been calculated, and then take a resolution to spend it wisely as well.” ENDS MEDIA CONTACT: Cathlen Fourie, 082 222 9198, cathlen@thatpoint.co.za, www.atthatpoint.co.za For more information on SAPA please visit: Website: http://www.sapayroll.co.za/ Twitter: @SAPayroll LinkedIn: The South African Payroll Association |

Welcome to the South African Payroll Association newsroom.

Archives

July 2020

Categories

All

|

RSS Feed

RSS Feed