|

The struggling South African economy has created considerable hardship, with low salary increases coupled with greater calls on disposable income. And this has resulted in a perfect storm driving people to commit fraud, says Arlene Leggat, a director of the South African Payroll Association (SAPA).

“People make unwise decisions when they are under sufficient pressure,” she states, adding that companies can help to combat high levels of payroll fraud by encouraging their payroll administrators to become members of a professional association. “Payroll administrators manage large amounts of money. It therefore makes sense to professionalise this industry from a number of viewpoints, not the least of which is the prevention of fraud,” Leggat puts forward. She states that if payroll professionals have signed up to a code of ethics, they understand the impact. Acting ethically is a conscious decision, and the more it is done, the more it becomes second nature. Additional measure “The other side of the equation is to ensure that the correct controls are in place.” Leggat advises companies to collaborate with their external auditors to design the most effective controls. Because they interact with so many organisations, auditors are best placed to advise on fraud patterns, and what controls work best. Given that payroll processes are software-driven, she adds that real-time variation reporting is emerging as a key mitigator of fraud risk. “Professionalisation, with its combination of an ethical code and ongoing education, and proper controls are the two pillars payroll-fraud detection and mitigation,” she concludes. “Fraud generally, and payroll fraud in particular, are real threats, but these basic measures can really help.” Drivers of professional membership “It’s a relatively new concept in South African payroll, but the trend towards professionalisation in other disciplines, such as tax practitioners and directors, is quite marked. The drivers are very similar: to ensure that people have the right skills for the job, that they sign on to a code of ethics and are subject to the professional association’s disciplinary procedures.” As a member of SAPA, a payroll administrator undertakes to adhere to its code of ethics, and to undertake structured continuous professional development to ensure his or her skills remain current. Any contravention of the code of ethics would lead to the rescinding of the professional certification. Globally, payroll fraud is the number-one source of accounting fraud and employee theft, according to the Association of Certified Examiners. It occurs in 27 percent of all businesses, and the average instance lasts on average for 36 months.[1] Research by PwC shows that South African companies suffer hugely from HR fraud, of which payroll fraud of various kinds is prominent: falsification of entitlement/ employee benefits (36%), false wage claims (39%), ghost employees on the payroll (30%) and misclassification of payroll expenses (16%).[2] ENDS [1] Matthew Garrett, “Payroll Fraud—A big threat and how to avoid it”, Forbes (10 September 2013), available at https://www.forbes.com/sites/matthewgarrett/2013/09/10/payroll-fraud-a-big-threat-and-how-to-avoid-it/#40c6826c746f. [1] PwC, Economic Crime: A South African pandemic (Global Economic Crime Survey 2016), available at https://www.pwc.co.za/en/assets/pdf/south-african-crime-survey-2016.pdf. MEDIA CONTACT: Idéle Prinsloo, 082 573 9219, [email protected], www.atthatpoint.co.za For more information on SAPA please visit: Website: http://www.sapayroll.co.za/ Twitter: @SAPayroll LinkedIn: The South African Payroll Association Fraud—A big threat and how to avoid it”, Forbes (10 September 2013), available at https://www.forbes.com/sites/matthewgarrett/2013/09/10/payroll-fraud-a-big-threat-and-how-to-avoid-it/#40c6826c746f. [2] PwC, Economic Crime: A South African pandemic (Global Economic Crime Survey 2016), available at https://www.pwc.co.za/en/assets/pdf/south-african-crime-survey-2016.pdf.

0 Comments

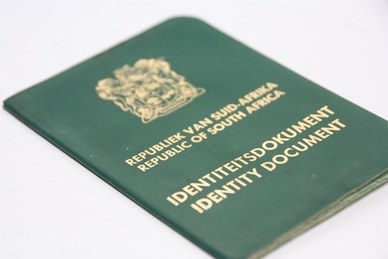

Payroll identity fraud is a reality in South Africa. Provincial departments, municipalities and the Department of Education are just a few of the examples where millions has been lost to ghost employees and other fraudulent payroll activities. Often, the payroll department is the last line of defence against fraud. “An alert payroll administrator can save their company thousands or even millions of Rands by recognising fraudulent schemes,” says Nicolette Nicholson, Director at the South African Payroll Association (SAPA). This form of fraud occurs when a person copies an unsuspecting victim's identity document to gain employment. The fraudster may make a new ID document that retains the valid ID number but displays their name and photograph. Or they could make a photocopy of the original and have it certified by an unsuspecting or unscrupulous commissioner of oaths. The fraudulent ID holder could be a foreign citizen who has crossed into South Africa illegally and wishes to find employment. They could also be someone with a criminal record and unable to gain employment because of their past. They may find work in lower wage brackets in industries where background checks are less strict. But they could get positions in higher paying jobs if an employer is negligent in taking precautionary measures. The consequences Once they're employed, the original ID holder and the employer may face consequences for the fake employee's actions. The victim will suffer high tax on income they never earned with the onus on them to prove the discrepancy. The employer could be held accountable for not performing identity and background checks. According to Nicholson, demanding and validating an original ID document is the best way to prevent identity fraud. “Never accept a copy, even a certified one, as evidence of identity,” she advises. “Then make sure the identity number and personal details appearing on the original document match the records at the Department of Home Affairs or other appropriate authority.” Employers should also check fingerprints. “It’s an excellent test because there's no way to forge the original ID holder's fingerprints,” says Nicholson. The fraudster may collude with corrupt staff who have access to HR records and can add their details to the company's books. If controls are not strictly enforced, or proper segregation of duties between HR, recruitment and payroll is not applied, this won't easily be detected. Nicholson recommends regular and snap audits throughout the personnel department to uncover irregularities. Blocked by payroll But if all else fails, there’s one final guard against identity fraud - the payroll administrator. They validate banking details provided by employees and should question where the account holder's credentials differ. Reports Nicholson, “Since the fraudster won't be able to open an account in the victim's name, that difference often catches them.” Payroll is also responsible for tax certificate reporting and will make sure the employee's PAYE registration number, identity number and date of birth correspond to those registered with SARS. Nicholson strongly recommends that companies obey the Protection of Personal Information Act (POPI). “An employee's personal information should always be kept confidential and protected in a manner prescribed by law,” she says. “Never hand ID copies or personal details to others because that's how ID fraud happens in the first place.” ENDS MEDIA CONTACT: Cathlen Fourie, 082 222 9198, cathlen@thatpoint.co.za, www.atthatpoint.co.za For more information on SAPA please visit: Website: http://www.sapayroll.co.za/ Twitter: @SAPayroll LinkedIn: The South African Payroll Association  Payroll fraud schemes typically last about 2 years before being detected, and are twice as frequent in small businesses as in larger ones. This is according a 2016 Global Fraud Study by the Association of Certified Fraud Examiners. Most often, perpetrators hold accounting positions (21.6% of cases). Cathie Webb, a Director of the South African Payroll Association (SAPA), says employers should be wary when their payroll administrator resists being away from the office. “It may be they’re afraid that someone standing in for them will uncover irregularities and expose them.” So a payroll administrator who never takes time off, arrives early, leaves late and works over weekends may seem dedicated. But they could also be committing payroll fraud. Apart from always being at their desk, such administrators are overly protective of their records, computerised or physical. They’ll insist that the work won’t be done correctly by those who don’t know their system but will avoid training backup personnel to perform their duties. How it starts “It often begins with financial difficulties at home,” suggests Webb. “The practitioner might create and pay a falsified employee or change their own pay rate for a single run just to get out of hot water.” But when the act goes unnoticed, it becomes easier to repeat and eventually snowballs into major fraud. Why the problem exists Unfortunately, blame falls squarely on the organisation. “In most cases we’ve witnessed, the shocked employer completely trusted the payroll administrator and never audited their work,” reports Webb. “It’s an accounting function and the same checks and balances need to be enforced.” How to prevent it Employers can take several steps to short-circuit payroll fraud: Employ a certified payroll practitioner The days when payroll was a ‘fallen into’ career, one which was discovered as someone worked their way up the ranks, are rapidly disappearing. Today, payroll is one of the pillars holding up the business, handling one of its biggest costs and providing strategic insight which transforms corporate communication and impacts on the bottom line. “When a business hires someone who has chosen a career in payroll, they are hiring someone who understands the challenges, knows how to minimise statutory risks and reputational damage and who can see the links between payroll, finance and HR,” says Webb. “They have the skill and knowledge to address any disconnect with management and are strategists who know their value and how to communicate with those in charge.” Today’s payroll practitioner is a strategic thinker who understands risk, recognises the potential for engagement across departments and knows the business from the inside out. Segregation of duties Certain payroll duties can be delegated to others. For example, the payroll practitioner prepares the banking file, but finance performs its submission to the bank. A third person should be responsible for checking that all the reporting balances. Additionally, the banking transactions should always require two authorisations, by people who clearly understand that the responsibility includes checking the details. Internal audits It’s good practice to perform regular audits to make sure the business is running smoothly. Include a thorough inspection of payroll records and processes. An approval process Payroll submissions should follow a systematic approval process with department or team managers reviewing and signing-off payroll for their staff. The financial director or CEO should also inspect and approve consolidated payroll for the company. Master record auditing It may be possible to place automatic alerts on changes to computerised master records, such as employee pay rates or bank detail changes. Secondary staff are alerted, and review and approve them. Task automation Some payroll tasks can be handled by a computerised process. Because calculations or processing happen in the background, there’s less opportunity to tamper with figures. Staff rotation Train backup staff to perform payroll duties so they can stand in for an absent payroll practitioner. But also have them perform payroll duties regularly so that one person never has complete control. Annual leave Force payroll practitioners to take annual leave. It’s a good way to prevent both fraud and burnout. A well-rested practitioner is more alert and less prone to errors that could also result in loss if undetected. Be proactive Your dedicated payroll practitioner may or may not be defrauding your company. “Rather than worrying about it,” advises Webb, “take time-tested steps to prevent the opportunity.” ENDS MEDIA CONTACT: Cathlen Fourie, 082 222 9198, cathlen@thatpoint.co.za, www.atthatpoint.co.za For more information on SAPA please visit: Website: http://www.sapayroll.co.za/ Twitter: @SAPayroll LinkedIn: The South African Payroll Association |

Welcome to the South African Payroll Association newsroom.

Archives

July 2020

Categories

All

|

RSS Feed

RSS Feed