|

Government has been enmeshed in the process of establishing a new National Minimum Wage (NMW) for many years and finally the numbers have landed on the table and it is causing consternation across country and company. Pressing questions remain around the still low amount, and its viability in the current economy, the history of oppression that surrounds the current wage structure, and the hackles of industry rising around the impact of the cost to bottom lines.

Perhaps the most important point to raise before discussing budgets and costs, is that the this proposed minimum wage of R3,464 a month for a 40-hour week at R20/hour would still be significantly less than the R5,544 that research shows would be the Minimum Living Level- in 2016. While the proposed increase will positively impact the quality of life for millions of South Africans, it is still not enough. “The current proposed minimum wage is R20 per hour and many would argue it is enough, but the reality is that South Africans in the unskilled job spectrum can barely make ends meet,” says Nicolette Nicholson, South African Payroll Association, Exco. “Enterprise or business may argue it is enough, but this NMW won’t break the poverty and inequality barriers.” However, it is a start towards promoting economic growth. Change is one small step Currently, the minimum wage is set at the sectoral level and the urban/rural level and is done in consultation with the Employment Conditions Commission. The new NMW will apply across all sectors. The Commission has to consider the ability of the employer to carry on business successfully and examines issues such as: the operation of the small, medium and micro enterprise, the cost of living, conditions of employment, income differentials and equality, and the impact of the increase to the enterprise. “The National Union of Metal Workers of South Africa remains opposed to NMW in its current form and Cosatu has pointed out that it is far from solving the challenges of inequality, poverty and unemployment,” says Nicholson. “They have, however, said it is a good start.” Enterprises not regulated under a wage regulating measure, such as the mining industry, are indicating that they will be unable to afford the increase. This view confirms the concerns raised by trade unions and analysts – that the NMW may escalate the unemployment crisis. “The NMW could have a further negative impact on the decline of job losses in the SME market,” concludes Nicholson. “The mines have already said they can’t afford it and may be retrenching staff. It is approximately a R7 difference from the average of R13 minimum wage if one compares rates across different industries and for most organisations the rise will make a significant impact on the bottom line.” There is no clear-cut path through the minefield that the NMW has opened up, but one fact does shine out – millions of people could see a necessary shift in their quality of life. The issues must be addressed to ensure that there is engagement on the NMW across all levels of business and that there is proper support for its success. The long-term sustainability of South Africa depends on it. ENDS MEDIA CONTACT: Idéle Prinsloo, 082 573 9219, [email protected], www.atthatpoint.co.za For more information on SAPA please visit: Website: http://www.sapayroll.co.za/ Twitter: @SAPayroll LinkedIn: The South African Payroll Association

0 Comments

Author: Nicolette Nicholson, director at the South African Payroll Association With a sluggish economy, low growth and our recent downgrade to junk status, South Africans now find themselves in a new national recession. At times like these, enterprises want a healthy workforce but are hard-pressed to fund it. However, employees, facing a higher cost of living, may feel it’s time to ask for a raise. Below is my advice to each party. Demanding or begging for an increase without warning is never a good idea, especially when times are tough. For the best chance of success, try the following strategy: Determine your worth Requesting a raise because you’re adding value is always better than simply asking for more money. If you don’t already have copies, ask HR for your employee history and performance reviews, and list how you’ve contributed to the company. Add anything you can remember and keep your information sources as evidence. Do an online salary survey of your position to determine what market related remuneration seems to be, and to arrive at a reasonable figure or percentage you can ask for. Remember that benchmarking your salary in the market is very important in order to understand whether you in fact are remunerated under your worth. Remember to take into account benefits such as pension / provident fund, medical aid, study assistance, or any other items provided by your company. Imagine the conversation that might take place and think of any possible objections to your request. Then come up with a logical, non-defensive response for each. You’ll be less flustered if you’re prepared, and it will build your confidence. Do not promote your hard work as a reason for a raise, rather highlight ways you engineered to work smarter and how this increases your value as an employee. Schedule a meeting Don’t ambush your manager. Rather schedule a meeting and let them know it’s about your salary to allow them time to prepare. At the meeting, be assertive but not combative as you state your position and provide your assessment. If they disagree, point to your evidence. While negotiating, never threaten to leave if you’re not willing and able to do so, as your bluff might be called. At the appropriate point, state your desired increase and be prepared to justify it. Also indicate if you’d be willing to settle for any perks that will save you money, such as working from home, working flexi-time or being allowed to bring your child to the office. If your manager needs approval for your raise, set a follow-up date with them and check back promptly. Be mindful to make an appointment with a line manager that has the mandate to motivate or reject your application. Don’t get caught up in a musical chair situation and by the time your application is placed on the table for discussion, it is no longer what you initially negotiated. The result If you win your increase, congratulations. However, if it’s denied, that doesn’t mean defeat. Keep adding value, while keeping an eye on the company financials and when profits start improving, ask again. If you feel strongly that you deserve better now, you could use your research to fill out your CV and begin looking further afield. While your employer may no longer have the funds to offer top financial compensation or benefits, other ways exist to reward and motivate employees. When considering alternative compensation, always strive to add value to your situation. Any benefits should be tangible and immediate to provide motivation on a daily basis. From a Business Perspective - Saving money Help employees get more from their earnings. Consider engaging a lifestyle coach or financial advisor to teach staff to achieve similar comforts from a more frugal budget, reduce waste, or focus on healthier, more mindful living. This illustrates your commitment to their wellbeing and motivates them to stay productive, while it shows that the business recognises the financial difficulties that tough economic times bring. Investing in a wellness programme can actually save money. They’ve been proven to reduce absenteeism, increase motivation and productivity, promote a sense of self-worth, reduce workplace stress, and make employees feel valued by the company. If possible, let staff work from home to reduce their travel costs and enjoy a sense of freedom. This can be one day a week, alternating days or any other scheme, but have measures in place to ensure strong communication and task tracking. Consider allowing staff to come to work and leave when they want to, as long as they’re present for an agreed number of hours. They can miss traffic to or from work and have greater control of their time, which is often more appreciated than extra pay. With new millennium technology, many office-based staff can easily schedule specific workdays to work from home. One may find that staff is more disciplined than anticipated and will appreciate this gesture as a benefit. This arrangement gives employees the opportunity to set a schedule that best works for them both personally and professionally. Children might not need to go to afterschool care if one parent can work from home. Productivity and quality of work is a given if this is agreed and managed properly. An employer can also save on workspace and equipment. SAPA will be hosting its annual conference this year titled Portraits of Success as follows:

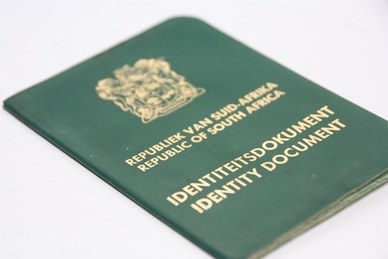

To register visit http://www.sapayroll.co.za/Events/Conference.aspx Photo caption: Nicolette Nicholson, Director at the South African Payroll Association ENDS MEDIA CONTACT: Idéle Prinsloo, 082 573 9219, [email protected], www.atthatpoint.co.za For more information on SAPA please visit: Website: http://www.sapayroll.co.za/ Twitter: @SAPayroll LinkedIn: The South African Payroll Associatio  Payroll identity fraud is a reality in South Africa. Provincial departments, municipalities and the Department of Education are just a few of the examples where millions has been lost to ghost employees and other fraudulent payroll activities. Often, the payroll department is the last line of defence against fraud. “An alert payroll administrator can save their company thousands or even millions of Rands by recognising fraudulent schemes,” says Nicolette Nicholson, Director at the South African Payroll Association (SAPA). This form of fraud occurs when a person copies an unsuspecting victim's identity document to gain employment. The fraudster may make a new ID document that retains the valid ID number but displays their name and photograph. Or they could make a photocopy of the original and have it certified by an unsuspecting or unscrupulous commissioner of oaths. The fraudulent ID holder could be a foreign citizen who has crossed into South Africa illegally and wishes to find employment. They could also be someone with a criminal record and unable to gain employment because of their past. They may find work in lower wage brackets in industries where background checks are less strict. But they could get positions in higher paying jobs if an employer is negligent in taking precautionary measures. The consequences Once they're employed, the original ID holder and the employer may face consequences for the fake employee's actions. The victim will suffer high tax on income they never earned with the onus on them to prove the discrepancy. The employer could be held accountable for not performing identity and background checks. According to Nicholson, demanding and validating an original ID document is the best way to prevent identity fraud. “Never accept a copy, even a certified one, as evidence of identity,” she advises. “Then make sure the identity number and personal details appearing on the original document match the records at the Department of Home Affairs or other appropriate authority.” Employers should also check fingerprints. “It’s an excellent test because there's no way to forge the original ID holder's fingerprints,” says Nicholson. The fraudster may collude with corrupt staff who have access to HR records and can add their details to the company's books. If controls are not strictly enforced, or proper segregation of duties between HR, recruitment and payroll is not applied, this won't easily be detected. Nicholson recommends regular and snap audits throughout the personnel department to uncover irregularities. Blocked by payroll But if all else fails, there’s one final guard against identity fraud - the payroll administrator. They validate banking details provided by employees and should question where the account holder's credentials differ. Reports Nicholson, “Since the fraudster won't be able to open an account in the victim's name, that difference often catches them.” Payroll is also responsible for tax certificate reporting and will make sure the employee's PAYE registration number, identity number and date of birth correspond to those registered with SARS. Nicholson strongly recommends that companies obey the Protection of Personal Information Act (POPI). “An employee's personal information should always be kept confidential and protected in a manner prescribed by law,” she says. “Never hand ID copies or personal details to others because that's how ID fraud happens in the first place.” ENDS MEDIA CONTACT: Cathlen Fourie, 082 222 9198, cathlen@thatpoint.co.za, www.atthatpoint.co.za For more information on SAPA please visit: Website: http://www.sapayroll.co.za/ Twitter: @SAPayroll LinkedIn: The South African Payroll Association by Nicolette Nicholson, Director, South African Payroll Association (SAPA) South African air carriers and operators are increasingly seeing the rest of the continent as an attractive growth target. No matter what particular business model they adopt in the target country, they are likely to find themselves seconding pilots, cabin crew, engineers and other employees to their in-country operations. In general, these expatriates would remain on the payroll of the South African or parent operator. Making salary payments to crew working in another country raises a whole set of inter-related issues that payroll professionals need to consider carefully. While not exhaustive, the following are some of the key areas to think about: Draft a cross-border remuneration policy It is critical that the operator has a policy in place that sets out the principles relating to how the company deals with employees working across borders. The policy should protect the interests both of the company and its employees. Many of the subsequent points would be integrated in the policy, as well as in the individual employee contracts. A payroll professional would be best suited to advise air carrier owners on what this policy should look like. Ensure that the employee is not disadvantaged by his or her secondment One important principle is that the employee should not be financially or otherwise disadvantaged by the requirement to work in a foreign country. At a practical level, this means considering carefully what the tax rules in the host country are—tax rates might be higher or tax compliance more complex—as well as the terms of the double taxation agreement between South Africa and the host country (if there is one). An added consideration here would be to consider how much time is expected to be spent outside of the Republic, and the impact this would have on tax. For example, it might be that the package is structured based on the fact that the employee is expected to be exempt from paying tax in South Africa because he or she is out of the country for more than 183 days in aggregate, 60 of which are continuous, in a 12 month period. Thought needs to be given to the impact of the employee forfeiting this tax exemption by having to make an unplanned trip home, either for business or personal reasons. If deemed a South African resident by SARS, an individual would be liable for normal taxes, including PAYE, and this could be hugely negative if the exemption condition is not met. How to handle such unexpected events should be covered in the policy. These kinds of complexities, and the fact that the unexpected could happen, means that many operators actually opt for simply paying a home nett salary and taking care of the employee’s tax themselves on behalf of the employee. Although this approach has the virtue of simplicity, it must also be recognised that SARS will treat this payment of employee PAYE as a payment of the employee’s debt. This is seen as a taxable benefit in the hands of the employee and thus increases the employer’s the cost of the employee. Structure the reward package carefully for tax compliance While ensuring that the employee is not disadvantaged, it is equally important that his or her cross-border package complies with the tax regimes in both countries. In practice, employees on secondment are usually paid a premium in the form of a hardship allowance or similar subsistence allowance, and this should be structured in a way that is beneficial to the employee while remaining tax-compliant in both countries. Both employee and employer need to fulfill their tax obligations to the host and home countries, and tax evasion should be avoided as it is a criminal offence. Give thought to medical aid and evacuation While an individual is on secondment in a foreign country, he or she would need to continue paying South African medical aid in order to avoid late joiner penalties. Late Joiner Penalties may be imposed on members over the age of 35 if they have not belonged to a medical aid before, or if they have had a break of more than 90 days from a medical aid. Depending on the number of years that they have not belonged to a medical aid, a late joiner penalty will be added to the member’s monthly contribution and worked out as a percentage of the contribution based on the total number of years a member has not been on a medical aid since the age of 35 years. But he or she would also need medical cover in the foreign country. Who pays for this, and what are the arrangements if urgent repatriation for medical or other reasons is indicated? Does the employee’s death benefit cover cross border deaths? Death is normally not a topic that forms part of general discussions, but an employer needs to make sure that the policy in place to cover death covers cross border eventualities. An employer might find themselves in trouble if such an event occurs and the employee was not covered outside the borders of South Africa. Ensure that proper precautions are in place as this can also result in an increase to the cost to the company. In conclusion, it should be apparent that this a complex area, and the payroll policy needs to be robust in order to copy with different eventualities. My advice would be for air carrier owners to work closely with a payroll practitioner that specialises in cross border remuneration structuring to understand the issues fully, and to structure the company policy and individual employment contracts. One might find that the cost to the company is much higher than budgeted for as the secondment could result in unanticipated costs if not thought through thoroughly before drafting both the business contract and the employee contract. ENDS MEDIA CONTACT: Cathlen Fourie, 082 222 9198, cathlen@thatpoint.co.za, www.atthatpoint.co.za For more information on SAPA please visit: Website: http://www.sapayroll.co.za/ Twitter: @SAPayroll LinkedIn: The South African Payroll Association By Nicolette Nicholson, Director, South African Payroll Association (SAPA)  South African companies— as well as many global multinationals—are increasingly seeing the rest of the continent as an attractive growth target. No matter what particular business model they adopt in the target country, they are likely to find themselves seconding specialist staff to their in-country operations. In general, these expatriates would remain on the payroll of the South African or parent company. Making salary payments to an employee working in another country raises a whole set of inter-related issues that payroll professionals need to consider carefully. While not exhaustive, the following are some of the key areas to think about: Draft a cross-border remuneration policy Chances are there will be more than one employee affected, so it is critical that the company has a policy in place that sets out the principles relating to how the company deals with employees working across borders. The policy should protect the interests both of the company and its employees. Many of the subsequent points would be integrated in the policy, as well as in the individual employee contracts. A payroll professional would be best suited to advise business owners on what this policy should look like. Ensure that the employee is not disadvantaged by his or her secondment One important principle is that the employee should not be financially or otherwise disadvantaged by the requirement to work in a foreign country. At a practical level, this means considering carefully what the tax rules in the host country are—tax rates might be higher or tax compliance more complex—as well as the terms of the double taxation agreement between South Africa and the host country (if there is one). An added consideration here would be to consider how much time is expected to be spent outside of the Republic, and the impact this would have on tax. For example, it might be that the package is structured based on the fact that the employee is expected to be exempt from paying tax in South Africa because he or she is out of the country for more than 183 days in aggregate, 60 of which are continuous, in a 12 month period. Thought needs to be given to the impact of the employee forfeiting this tax exemption by having to make an unplanned trip home, either for business or personal reasons. If deemed a South African resident by SARS, an individual would be liable for normal taxes, including PAYE, and this could be hugely negative if the exemption condition is not met. How to handle such unexpected events should be covered in the policy. These kinds of complexities, and the fact that the unexpected could happen, means that many companies actually opt for simply paying a home nett salary and taking care of the employee’s tax themselves on behalf of the employee. Although this approach has the virtue of simplicity, it must also be recognised that SARS will treat this payment of employee PAYE as a payment of the employee’s debt. This is seen as a taxable benefit in the hands of the employee and thus increases the employer’s the cost of the employee. Structure the reward package carefully for tax compliance While ensuring that the employee is not disadvantaged, it is equally important that his or her cross-border package complies with the tax regimes in both countries. In practice, employees on secondment are usually paid a premium in the form of a hardship allowance or similar subsistence allowance, and this should be structured in a way that is beneficial to the employee while remaining tax-compliant in both countries. Both employee and employer need to fulfill their tax obligations to the host and home countries, and tax evasion should be avoided as it is a criminal offence. Give thought to medical aid and evacuation While an individual is on secondment in a foreign country, he or she would need to continue paying South African medical aid in order to avoid late joiner penalties. Late Joiner Penalties may be imposed on members over the age of 35 if they have not belonged to a medical aid before, or if they have had a break of more than 90 days from a medical aid. Depending on the number of years that they have not belonged to a medical aid, a late joiner penalty will be added to the member’s monthly contribution and worked out as a percentage of the contribution based on the total number of years a member has not been on a medical aid since the age of 35 years. But he or she would also need medical cover in the foreign country. Who pays for this, and what are the arrangements if urgent repatriation for medical or other reasons is indicated? Does the employee’s death benefit cover cross border deaths? Death is normally not a topic that forms part of general discussions, but an employer needs to make sure that the policy in place to cover death covers cross border eventualities. An employer might find themselves in trouble if such an event occurs and the employee was not covered outside the borders of South Africa. Ensure that proper precautions are in place as this can also result in an increase to the cost to the company. In conclusion, it should be apparent that this a complex area, and the payroll policy needs to be robust in order to copy with different eventualities. My advice would be for business owners to work closely with a payroll practitioner that specialises in cross border remuneration structuring to understand the issues fully, and to structure the company policy and individual employment contracts. One might find that the cost to the company is much higher than budgeted for as the secondment could result in unanticipated costs if not thought through thoroughly before drafting both the business contract and the employee contract. ENDS MEDIA CONTACT: Cathlen Fourie, 082 222 9198, cathlen@thatpoint.co.za, www.atthatpoint.co.za For more information on SAPA please visit: Website: http://www.sapayroll.co.za/ Twitter: @SAPayroll LinkedIn: The South African Payroll Association  The South African Payroll Association (SAPA) says that the proposed amendments to the Magistrates’ Court Act 32 of 1944, aimed at curbing unconstitutional practices relating to garnishee orders, are to be welcomed. The Association has urged Parliament to press ahead with tabling the bill now that the local government elections are complete. “The new bill is an excellent piece of legislation that corrects some of the glaring faults in the existing law, which have greatly prejudiced large numbers of vulnerable workers,” says Nicolette Nicholson, director at SAPA. “Because the current Magistrates Act sets no cap on garnishee orders, and the Basic Conditions of Employment Act cap personal deductions only, employees can find themselves with no pay to take home, clearly something that is not sustainable either for the individual or the company.” Proposed Amendments In terms of the proposed amendments, says Nicholson, a maximum of 25 percent of a person’s salary will be able to be garnished—it’s not clear yet whether of gross or nett salary. Under the new bill, garnishee orders will have to be filed in the court whose jurisdiction covers the area where the debtor resides. Whereas the present law allows garnishee orders to be issued by any magistrate’s court, making it easy for companies to approach courts anywhere in the country that are known to grant orders easily—or, indeed, where they may have a corrupt relationship with a specific court official. The new bill also tightens up on the issuing process to force magistrates to investigate thoroughly the debtor’s financial position in order to ensure orders are just and equitable. Furthermore, the new bill gives employers the responsibility of ensuring that salary deductions are made timeously (or risk becoming liable for any interest on arrears), and of stopping deductions when the amount stipulated in the judgement is paid in full. “These are all very good moves to protect employees,” says Nicholson. “However, one concern is the extra burden this places on payroll departments. My advice would be for companies with large workforces to engage the services of a reputable third-party service provider to manage the garnishee orders.” The proposed amendments have been approved by Cabinet and are now due to be considered by the Portfolio Committee on Justice and Correctional Services, although the date has not yet been set. In the meantime, says Nicholson, irrespective of the law, employees need to take responsibility for their own actions. Take responsibility However, the onus still falls on consumers to take responsibility for their spending. “Every citizen is responsible for conducting his or her financial affairs responsibly—that’s the bottom line,” says Nicholson. “If one lives above one’s means, then there will be consequences. In particular, employees must avoid relying on their variable income to fund their lifestyles—bonuses, overtime and the like are not part of the salary package and will vary in line with company performance. For example, many people find themselves receiving a garnishee order because they are relying on a bonus to pay for something, and then the bonus doesn’t materialise.” If employees run into trouble, she concludes, they should definitely turn to their employers for help. Although there is no legal obligation to provide financial or debt counselling, many companies do so, or would be prepared to refer an employee to someone who could help. In addition, most of the big retirement funds offer financial well-being services. “Help is definitely available—look for it,” she advises. “A problem with debt compounds quickly, so the earlier one begins with a solution, the better.” ENDS MEDIA CONTACT: Idéle Prinsloo, 082 573 9219, [email protected], www.atthatpoint.co.za For more information on SAPA please visit: Website: http://www.sapayroll.co.za/ Twitter: @SAPayroll LinkedIn: The South African Payroll Association  The Association of Certified Fraud Examiners says that payroll fraud is the No. 1 source of accounting fraud and employee threat globally. It affects 27% of all businesses and lasts, on average, 36 months. South African statistics are scarce, mostly because payroll fraud is under-reported by companies jealous of their reputations. A rare public case was the arrest in 2014 of two Eskom employees for tampering with the corporation’s payroll network system in a scheme that could have costed the company billions. Research by Alexander Forbes in 2011 showed that payroll fraud was costing South African business more than R100-million a year. “Payroll fraud is very much a reality and, in South Africa, my experience is that it’s most prevalent in medium to large companies that run electronic payroll systems, and where the number of employees makes manual checking difficult,” says Nicolette Nicholson, director at the South African Payroll Association. She adds that payroll fraud is an occupation, “The books will be balanced legally on the system, because it has applied legislation. But typically, the fraud takes place when new data is entered onto the system, and that’s why it’s not easily picked up by financial audits.” Nicholson explains that payroll fraud usually requires collusion between colleagues, and small transactions that do not trigger alerts are preferred—one reason fraud schemes go on for so long. Most payroll fraud hinges on overtime claims, the payment of salaries to ghost employees whose bank accounts are controlled by the fraudster, dishonest expense claims and the payment of an extra month’s salary when an employee resigns or dies. Causes for payroll fraud include intent and character, as well as peer pressure – where a person’s financial circumstances make them vulnerable to syndicates. Nicholson advises that the best defence is to make a company a low-risk candidate by following these tips: - Put controls in place from the beginning. Duties related to payroll processes should be rigorously segregated, with different people responsible for input, approval and release as a minimum. Frequent spot audits should be performed in addition to external audits, which do not cover segregation of duties. - Use external fraud examiners, as most fraud is committed by managers, an external agency should be used to undertake fraud checks. - Ethics management is a pillar of King III for very good reason: if the company’s code of ethics is truly embedded into the corporate culture, the occasional rotten apple will find it harder to identify accomplices. - Achieve process stability. Pay day is an emotive issue, so small issues tend to get ignored in favour of getting the payroll run underway. It is critical to keep to payroll procedures and cycles, or controls will be abandoned. - Empower employees. Very often, blue-collar workers may be barely literate or may have a culture of not questioning payment. Work with union or employee representatives to educate employees about what information should appear on their payslips, and encourage them to check that information for accuracy. It should also help nurture a culture of trust that is likely to impact positively on productivity generally. - Leverage the power of data. Put basic business intelligence capabilities in place to enable exception reporting and trend analysis to spot anomalies in overtime, PAYE, tax on bonuses and so on. Early detection is critical. - Stern consequences. Criminal action should be taken against an employee caught committing payroll fraud, if the consequences are kept to a mere human resources disciplinary or suspension, the guilty party can go onto work for the next company where he/she can continue their misconduct. This is because the Labour Law does not allow unwarranted reference, in other words, if the guilty person’s potential new employer calls the previous employer for a reference, they cannot divulge anything about the person’s fraudulent activities. However, if the person is pursued criminally, the previous employer is allowed to do so. “Fraud can have serious consequences for any company, both financial and in terms of the corporate culture,” concludes Nicholson. “Making it hard to commit it in the first place makes good business sense in every way.” ENDS MEDIA CONTACT: Idéle Prinsloo, 082 573 9219, [email protected], www.atthatpoint.co.za For more information on SAPA please visit: Website: http://www.sapayroll.co.za/ Twitter: @SAPayroll LinkedIn: The South African Payroll Association  Payslips are among the most important documents people receive, yet few pay enough attention to them, says Nicolette Nicholson, director at the South African Payroll Association (SAPA). “Too many people just see their payslip as confirmation that their salary has been paid and they can relax,” she says. “In fact, it’s an extremely important document and it’s worth checking it carefully to make sure it is accurate. Mistakes could cost you dearly in the long run and you are responsible for making sure the payslip is accurate. “Everybody should file all the payslips they ever receive and keep them forever!” Nicholson continues that a payslip is first and foremost the irrefutable record of a person’s work service for any employer. It provides factual proof of the jobs he/she have held and what they were paid. It’s also the receipt for work performed and should be carefully compared with the letter of appointment, contract or other official documents to ensure that a person’s work is being properly rewarded. Also confirm that the correct employer name and address appears on the payslip. Payslips typically have four main types of information: the fixed salary or contract of employment; the variable income for things like overtime; the deductions area, which would include statutory and personal deductions; and the statistical area, which includes annual and sick leave, job description and so on. Job descriptions are often omitted to avoid potential conflict between employees, Nicholson notes, but this is not good practice. Deductions A particular point to notice is that personal deductions cannot exceed 25% of a person’s gross pay, and businesses have the responsibility of protecting their workers’ interests here. This means, for instance, that a company’s payroll department has the obligation to act on statutory deductions and in the case of an emolument order to contact the attorney if the garnishee exceeds this ceiling and guide the employee to make arrangements to lower the repayment value on the court order. However, the onus still falls on employees to check these deductions carefully. Staying with deductions, Nicholson says that it is also critical to check that contributions to pension or provident funds, among others, have been properly made. If the incorrect deductions have been made, it will affect retirement income and pay-outs, as well as death benefits. Another important figure to check is tax and unemployment insurance deductions. The employee should also ensure that these deductions have actually been paid over to the taxman and Department of Labour respectively on the IRP5 certificate issued at the end of the tax year. “These authorities will hold the employee liable alongside the employer if the right taxes are not paid,” she adds. Structuring Payslips will also reflect how an individual’s pay is structured and it’s prudent to make sure that this structuring is legal and harmonises with the job description. For example, travel benefits that are simply there to help reduce the tax liability are not advisable. Tax evasion, or actions aimed at not paying tax, is a very serious offence and carries jail time; while tax avoidance that refer to using legal ways to reduce tax, is less serious, but can attract a fine of up to 200%. Nicholson puts forward that it is good practice to ask for a dummy payslip before accepting a job. This will enable a person to determine whether the deductions are fair and that take-home pay is at the expected level. “If there’s something on your payslip you don’t understand or don’t agree with, take it up with your immediate boss, who will escalate to the payroll department,” Nicholson concludes. “If you don’t get satisfactory answers, your union representative should be able to help.” ENDS MEDIA CONTACT: Idéle Prinsloo, 082 573 9219, [email protected], www.atthatpoint.co.za For more information on SAPA please visit: Website: http://www.sapayroll.co.za/ Twitter: @SAPayroll LinkedIn: The South African Payroll Association |

Welcome to the South African Payroll Association newsroom.

Archives

July 2020

Categories

All

|

RSS Feed

RSS Feed