Ditch the rigid, bureaucratic, one size fits all business model - its time has come. The organisation is facing challenging times. Budgets must be closely watched, performance measured and results driven. However, the people that make up the lifeblood of the business must still be nurtured and rewarded, given credit and recognition for the work that they do and inspired to loyalty.

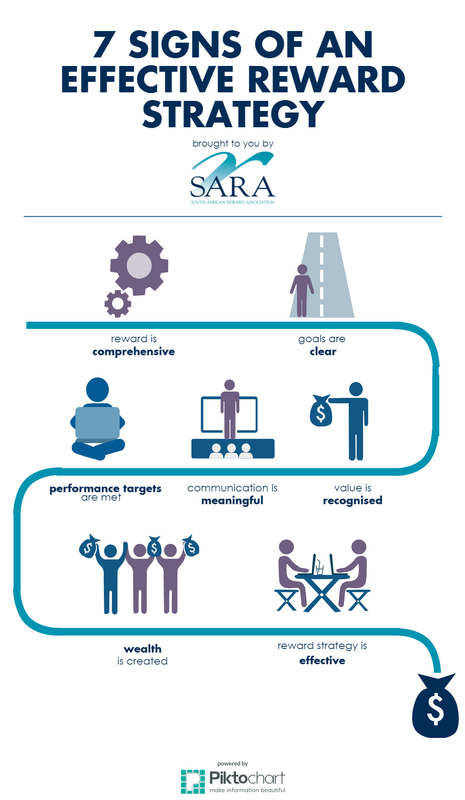

“For a business to thrive it needs the engagement and commitment of its employees,” says Dr Mark Bussin, Exco member of the South African Reward Association (SARA). “This can be found in a well-structured reward strategy.” These rewards are the financial and non-financial returns given to employees in exchange for their time, talents, efforts and results. Dr Bussin shares seven signs that prove the organisation is doing their job here well. The reward is comprehensive Total Rewards describes the strategy of blending money, benefits, work/life, performance and recognition, development and career opportunities into one complete package. This type of solution is far more likely to attract talent alongside motivating and retaining it. The goals are clear A well-designed Total Reward plan provides an integrated approach for reward management, aligns reward practices with the business strategy and adheres to legal, ethical and best practice standards. Performance targets are met “If the organisation is meeting fundamental financial performance targets and providing superior total return to shareholders, then you know your reward strategy is working. The total reward strategy underpins the business strategy and supports achievement of the targeted financial returns,” says Dr. Bussin. Communication is meaningful An excellent reward strategy is an art, and if the CEO, board, investors and analysts communicate in a meaningful way and the reward system encourages the CEO to align with the shareholders and vice versa, then it is on track to success. Value is recognised “A well-implemented solution will see that the board has sufficient understanding of the total reward strategy to know where to look for answers and approach experts,” says Dr. Bussin. “The board uses its resources and taps into the experiences and wisdom of a diverse range of directors. In addition, the board acts cohesively and as a collective, not breaking down into factions. A great reward system encourages team behaviour.” Wealth creation Through a well-managed and crafted reward strategy, the CEO and the long term investors are creating substantial levels of wealth. The reward system is focused on the long term sustainability of the organisation and producing superior returns over a long period of time. It is effective An effective reward strategy is based on sound principles and practices, is reliant on the achievement of desired outcomes, is positive and meaningful and impacts behaviour in the right ways. If it works, the talent pipeline will be packed with CEO candidates as the organisation has a reward system that has clear succession planning and there are no surprises. “A good reward system allows the employee to know well in advance how they are doing and if they will earn, say, a bonus,” concludes Bussin. “It rewards succession planning and penalises job preservation by holding onto information.” ENDS MEDIA CONTACT: Cathlen Fourie, 012 644 2833, [email protected], www.atthatpoint.co.za For more information on SARA please visit: Website: www.sara.co.za Twitter: @SA_reward LinkedIn: South African Reward Association Facebook: SARA – South African Reward Association

0 Comments

South Africa is desperate for skilled professionals to urgently bolster economic growth  Martin J R Westcott, the Executive Chairman of P E Corporate Services Martin J R Westcott, the Executive Chairman of P E Corporate Services Fragile markets, stringent visa laws and a surge globally of violence against foreigners have done little to curb businesses sending staff on assignments abroad. South Africa is coming out as a top location for international professionals finding employment, along with its developing BRIC counterparts. “South Africa could do well to embrace in-bound mobility and create total reward packages that speak to the individual needs of these professionals,” says Martin J R Westcott, the Executive Chairman of P E Corporate Services. “The fact that skills shortages in South Africa are both substantial and entrenched is a key factor constraining economic growth.” Westcott, speaking on expatriation trends during a workshop of the South African Reward Association (SARA), identified how the economic slow-down and fewer job opportunities in developed economies are seeing a steady reversal of the country’s net ‘brain drain’. This is combined with a severe slippage of exchange rate and the country’s comparatively high standard of living. “Our most recent international pay comparison studies indicate that South Africa is ranked second only to the United States in terms of purchasing power of the net disposable income enjoyed by executives and professionals,” explained Westcott. Balancing mobility and remuneration “Individuals who are well established in their jobs in the home country will take an off-shore assignment provided that it is financially beneficial for the entire family,” says Nevan Naidoo, the Head of Reward across Africa for the Standard Bank Group. “Employees focusing on career advancement, with ambitions of taking on more senior roles in a global organisation, will see assignments off-shore as a platform for advancement. In these instances planned succession will be a key driver instead of money.” “The appointment of foreign nationals must be contextualised and well understood by local employers to prevent any frustration,” says Naidoo. “While security challenges are one of the main areas that influence expatriation considerably, businesses are creating the necessary awareness regarding operating in Africa specifically,” adds Kohl Van Rensburg, Head of Reward: Africa, Retail Banking and Wealth for the Standard Bank Group. “Companies are being pro-active in making sure they remain safe: that good evacuation processes are in place, excellent global medical cover is provided, and so on.” The division between home country and host country approaches to expatriate remuneration have been near on par for many years. Most expatriates who relocate for short to medium term assignments retain domestic financial commitments which create practical difficulties in switching to a host country pay model. Van Rensburg recommends that businesses adopt the split payroll methodology; where “a percentage of salary is paid in the home country with a smaller percentage paid in the host country, dependant on cost of living indices in the host country.” While there must be correct processes and systems in place to ensure a company’s expatriation policy is well executed, measuring the success of assignments is difficult and dependent on specifics of the assignment, says Westcott: “There has, however, been very strong growth in the use of key performance indicators (KPI) for performance evaluation and bonus determination in recent years and, in particular, the alignment of KPIs with corporate and business unit strategies.” ENDS MEDIA CONTACT: Cathlen Fourie, 012 644 2833, [email protected], www.atthatpoint.co.za For more information on SARA please visit: Website: www.sara.co.za Twitter: @SA_reward LinkedIn: South African Reward Association Facebook: SARA – South African Reward Association  Musa Masingi, Nkateko Sithole, Nyeleti Mugari and Pumelela Mpengula will go down in history as the tenth group of graduates that have benefited, together with industry, from the South African Reward Association (SARA) internship programme. The programme was launched in 2006 to offer South Africa the best in Total Reward – a profession very few people know about. “Total Reward includes everything valuable to an employee in relation to his/her employment, including salary, benefits and their experience of their workplace,” says Yolanda Sedlmaier, head of the SARA internship programme. “Reward professionals make sure an employer does everything it can to attract, inspire and retain the best possible workforce, while still increasing profits year on year.” SARA is a professional body, approved by the South African Qualification Authority (SAQA) that aims to promote and develop the reward profession in South Africa. SARA facilitates training, networking events, an annual conference and accredits Reward Specialists with professional designations. As part of its development efforts, SARA annually accepts into its internship programme four previously disadvantaged South Africans that have obtained a Bachelors or Honours degree in Industrial Psychology, Human Resources Management, Organisational Psychology, or People Management. All 35 interns that have completed the programme since 2006 have accepted employment opportunities in the reward field at the end of the programme. The programme runs for six months and is structured to provide an opportunity for the interns to learn the basics of the reward profession. The interns are also expected to complete the Global Remuneration Professional (GRP) qualification, attending various training opportunities by the country’s top reward professionals and spending time with SARA member companies to gain valuable practical experience. The programme also includes work readiness training, and provides each intern with a laptop and the associated tools required to kick-start their careers. “We are immensely grateful to our 2015 sponsors; PwC, the Hay Group, SARS and Dimension Data,” says Sedlmaier. “With their support, the reward industry in SA has this year once again gained four future leaders who will make a significant difference to the businesses in which they operate, and communities that they serve.” ENDS MEDIA CONTACT: Cathlen Fourie, 012 644 2833, [email protected], www.atthatpoint.co.za For more information on SARA please visit: Website: www.sara.co.za Twitter: @SA_reward LinkedIn: South African Reward Association Facebook: SARA – South African Reward Association Are you being paid what you are worth?

Take home salaries must be addressed to ensure that people earn what they are worth. Salary structures are as varied and different as the organisations that pay them. Some are structured to ensure that the employee gains significant financial rewards; others are not. “It is important for the job seeker to understand if the company is offering a basic pay and benefits or if the company is offering a total package (cost to company),” says Nazlie Samodien, South African Rewards Association (SARA) Exco member. “Take home pay can vary depending on how the company’s remuneration is structured. I’ve seen job seekers earning a basic salary of R15, 000, for example, being offered a total package of R20, 000. They are under the impression that they are being offered an increase of more than 30% without knowing that they must now pay for all the benefits from the total package that is being offered.” According to Samodien there is no rule of thumb on what to ask for on remuneration, it is dependent on the seniority of the role, the scarcity of skills that the job seeker has, the availability of variable remuneration such as commission and the level of experience that the job seeker has to offer. There are a number of considerations that the employee or job seeker needs to take into consideration before accepting a salary offer. Establish payment structure The first is to establish whether or not there is variable pay such as a commission and how the company structures the commission scheme. “I would advise that potential employees ask what the average commission payments have been with other employees in the role over the past six months,” says Samodien. “This will then put them in a better position to understand what measures are used to calculate commission and how hard or easy it will be to earn.” Consider total earnings This incorporates any other incentives provided by the business such as bonus payments or long term incentive schemes. An employee can be worse off if they don’t consider these variable pay elements over both the short and long term. “Depending on what a candidate is sacrificing in their current role they may want to negotiate this on appointment,” says Samodien. “For example, if they are eligible for a bonus with their current employer and the payment is imminent, you can negotiate an on-appointment bonus with the new company. It is also worthwhile asking the new company for a mock payslip so that it is obvious to see what will be paid into the bank account once all the deductions have been made.” “Depending on the role, the successful candidate may need to do a lot of travel and a company car or fuel card may need to be factored in,” says Samodien. “Then there is medical aid, retirement plans and income protection benefits for the employee in the event of death or disability. It is worth asking what the returns on the retirement funds have been over the past five years and what the taxes on these benefits will be.” Work/life balance In addition, it is important that the employee establish those aspects of work-life balance that they need to thrive. Many organisations offer gyms, crèches, wellness centres and more, ensuring that their staff have opportunities to unwind or look after their children. Performance incentives “Some employers have outstanding recognition programmes that are linked to performance and that can include overseas trips and these form part of the employee value proposition,” concludes Samodien. “Job seekers need to consider all of the reward elements that are on offer, especially if the pay element is not quite what was expected, to determine if the long term benefits will outweigh the short term salary sacrifice.” ENDS MEDIA CONTACT: Cathlen Fourie, 012 644 2833, [email protected], www.atthatpoint.co.za For more information on SARA please visit: Website: www.sara.co.za Twitter: @SA_reward LinkedIn: South African Reward Association Facebook: SARA – South African Reward Association |

Archives

March 2023

Welcome to the South African Reward Association newsroom.

Categories

All

|

RSS Feed

RSS Feed